Guide to Understanding Accounts Receivable Days (A/R Days)

Are you a business owner or manager concerned about your company’s financial health and cash flow? If so, understanding the Accounts Receivable Days (ARD) concept is essential.

ARD is a key financial metric that measures the efficiency of your business in collecting outstanding payments from customers. By monitoring and managing ARD effectively, you can improve your company’s cash flow, financial stability, and customer relationships.

This article will provide a comprehensive guide to Accounts Receivable Days, including what it is, why it matters, and strategies for improving it. So, let’s dive in and explore this critical financial metric that can make or break your business’s success!

What are Account Receivable Days?

Account Receivable Days (ARD) is a financial metric that measures the average number of days it takes for a business to collect payment from its customers for goods or services that have been delivered but not yet paid for. It is an important metric for businesses because it reflects how efficiently they manage their cash flow and collect payments from customers.

How to Calculate A/R Days?

To calculate ARD, businesses divide their total Accounts Receivable (AR) by their total sales and then multiply the result by the number of days in the period being measured (usually a year).

Formula to Calculate A/R Days

The formula for ARD is as follows:

ARD = (Accounts Receivable / Total Sales) x Number of Days

Example of A/R Days

If a business has $50,000 in AR and $500,000 in sales over a 365-day period, the calculation for ARD would be as follows:

ARD = ($50,000 / $500,000) x 365

ARD = 36.5

This means that, on average, it takes the business 36.5 days to collect payment from its customers after delivering goods or services.

By monitoring ARD, businesses can identify potential cash flow problems, such as slow-paying customers or poor collection practices, and take steps to improve their collection processes. Additionally, tracking ARD over time can help businesses evaluate the effectiveness of their collection efforts and identify trends that may impact their financial health. Overall, managing ARD is an important aspect of financial management for businesses of all sizes.

Significance of Account Receivable Days to a Business

Account Receivable Days (ARD) is a significant financial metric for businesses as it provides insights into the efficiency of their collection processes and the overall health of their cash flow. Here are some of the key ways in which ARD is significant to a business:

- Cash Flow Management: ARD directly impacts a business’s cash flow. A longer ARD means that a business is waiting longer to receive payment from its customers, which can cause a strain on its cash reserves. By managing ARD effectively, businesses can improve their cash flow and ensure they have enough funds to meet their financial obligations.

- Financial Health: ARD is also an indicator of a business’s financial health. A high ARD could mean that a business is experiencing difficulty in collecting payments from its customers, which can be a warning sign of potential financial trouble. Monitoring ARD can help businesses identify areas for improvement in their collection processes and take corrective action before the problem worsens.

- Customer Relationships: Effective management of ARD can help improve customer relationships. By collecting payments promptly, businesses can build trust and goodwill with their customers, which can lead to repeat business and positive word-of-mouth referrals.

- Decision Making: ARD can also inform business decision-making. For example, a business with a high ARD may need to consider financing options or renegotiating payment terms with customers to improve its cash flow. By understanding their ARD, businesses can make informed decisions about pricing, sales, and credit policies.

Impact of Extended Account Receivable Days on Cash Flow

Extended Account Receivable Days (ARD) can significantly impact a business’s cash flow. When ARD is prolonged, a business has delivered goods or services to its customers but has not yet received payment. This delay in payment can cause cash flow problems for businesses, especially those that rely heavily on timely payments from customers to meet their financial obligations.

Here are some of the ways in which extended ARD can impact a business’s cash flow:

- Reduced Cash Reserves: When customers take longer to pay, businesses have less cash. This can make it difficult for them to pay bills, make investments, or cover unexpected expenses.

- Increased Borrowing Costs: Businesses that rely on financing to cover cash flow gaps may face higher borrowing costs when ARD is extended. This is because lenders view businesses with longer ARD as a higher risk, which can result in higher interest rates and fees.

- Strained Vendor Relationships: When businesses are unable to pay their bills on time due to extended ARD, it can strain relationships with their vendors. This can result in vendors cutting off credit or demanding payment upfront, which can further exacerbate cash flow problems.

- Missed Opportunities: Extended ARD can also lead to missed opportunities for businesses. For example, a business may miss out on a growth opportunity or be forced to delay investing in new equipment or technology due to a lack of available cash.

Impact of Poor Account Receivable Days Management on Customer Relationships

Poor Account Receivable (AR) Days management can significantly impact customer relationships. Here are some of the ways in which poor AR Days management can impact customer relationships:

Strained Communication

When businesses have poor AR Days management, it often means that customers are not being billed or reminded to pay in a timely manner. This lack of communication can result in confusion and frustration for customers, leading to strained relationships.

Loss of Trust

When businesses fail to follow up on outstanding invoices or are inconsistent in their billing practices, it can erode customer trust. Customers may begin to question the business’s reliability and credibility, leading to a loss of trust and potentially damaging the relationship.

Negative Impact on Reputation

Poor AR Days management can also impact a business’s reputation. If customers feel that they are not being treated fairly or that their payments are not being acknowledged or processed in a timely manner, they may share their negative experiences with others. This negative word-of-mouth can damage the business’s reputation and result in lost business opportunities.

Customer Satisfaction

Poor AR Days management can also impact customer satisfaction. When customers are unsure of their account status or feel that they are being unfairly charged or penalized, it can lead to dissatisfaction and a lack of loyalty. This can ultimately result in lost revenue and decreased profitability for the business.

Strategies for Improving Account Receivable Days

Here are some strategies for improving AR Days:

- Establish Clear Payment Terms: Clearly outlining payment terms and expectations upfront can help to avoid confusion and ensure timely payments. This includes setting due dates, outlining penalties for late payments, and providing multiple payment options.

- Invoice Promptly and Accurately: Invoicing promptly and accurately can help ensure that customers know their outstanding balances and are motivated to make timely payments. It is also important to ensure that invoices are free of errors and are easy to understand.

- Follow Up on Outstanding Invoices: Following up on outstanding invoices is crucial for improving AR Days. This includes sending reminders to customers about upcoming or overdue payments and following up promptly on any disputes or discrepancies.

- Streamline Payment Processes: Streamlining payment processes can help to make it easier and more convenient for customers to make payments. This includes offering online payment options, automatic billing, and mobile payment options.

- Monitor AR Days: Regularly monitoring AR Days can help businesses to identify any areas where improvements can be made. It is important to track progress and make adjustments as needed to ensure that AR Days remain within acceptable levels.

- Establish Credit Policies: Credit policies can help manage risk and ensure that customers are financially capable of making payments. This includes performing credit checks, setting credit limits, and implementing a credit approval process.

Effective Billing and Payment Collection Strategies

Here are some strategies that businesses can implement to improve their billing and payment collection processes:

Send Invoices Promptly and Accurately

Invoicing promptly and accurately can help ensure that customers know their outstanding balances and are motivated to make timely payments. Ensuring that invoices are free of errors and easy to understand is important.

Provide Multiple Payment Options

Offering multiple payment options can make it easier and more convenient for customers to make payments. This includes offering online payment options, automatic billing, and mobile payment options.

Establish Clear Payment Terms

Clearly outlining payment terms and expectations upfront can help to avoid confusion and ensure timely payments. This includes setting due dates, outlining penalties for late payments, and providing multiple payment options.

Follow Up on Outstanding Invoices

Following up on outstanding invoices is crucial for improving AR Days. This includes sending reminders to customers about upcoming or overdue payments and following up promptly on any disputes or discrepancies.

Implement a Payment Plan

For customers who may be experiencing financial difficulties, offering a payment plan can be a helpful option. This allows customers to make smaller, more manageable payments over time, which can help improve their ability to pay.

Automate Payment Collection Processes

Automating payment collection processes can help to ensure timely payments and reduce the risk of human error. This includes setting up automatic payment reminders and using automatic payment processing software.

Monitor Payment Collection Processes

Regularly monitoring payment collection processes can help businesses to identify any areas where improvements can be made. It is important to track progress and make adjustments as needed to ensure that AR Days remain within acceptable levels.

Monitoring and Measuring Account Receivable Days

Monitoring and measuring Account Receivable (AR) Days is crucial for maintaining a healthy business cash flow and financial stability. Here are some key metrics and methods for monitoring and measuring AR Days:

Average Collection Period (ACP)

The ACP is a metric that measures the average number of days it takes for a business to collect payment from its customers. It is calculated by dividing the total AR by the average daily sales. A lower ACP indicates that a business is collecting payments more quickly, while a higher ACP indicates that a business is taking longer to collect payments.

Days Sales Outstanding (DSO)

The DSO is a metric that measures the average number of days it takes for a business to collect payment from its customers. It is calculated by dividing the total AR by the total credit sales and multiplying by the number of days in the period. A lower DSO indicates that a business is collecting payments more quickly, while a higher DSO indicates that a business is taking longer to collect payments.

Aging Report

An aging report is a summary of a business’s outstanding invoices, categorized by the length of time they have been outstanding. This report provides insight into which invoices are overdue and by how long and can be used to identify areas where improvements can be made.

Collection Effectiveness Index (CEI)

The CEI is a metric that measures a business’s ability to collect payments from its customers. It is calculated by dividing the amount collected by the total amount of outstanding AR and multiplying it by 100. A higher CEI indicates that a business is collecting payments more effectively, while a lower CEI indicates that a business is struggling to collect payments.

Use of Financial Ratios to Track Changes in Account Receivable Days

Financial ratios can be useful tools for tracking changes in Account Receivable (AR) Days over time. Here are two key ratios that can be used for this purpose:

Accounts Receivable Turnover Ratio

The Accounts Receivable Turnover Ratio is a financial ratio that measures how many times a business can collect its average accounts receivable balance during a specific period, usually a year.

The formula for the ratio is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A high Accounts Receivable Turnover Ratio indicates that a business is collecting payments from customers quickly. In contrast, a low ratio indicates that a business is taking a long time to collect payments.

By comparing the Accounts Receivable Turnover Ratio over multiple periods, a business can track changes in AR Days and identify areas where improvements can be made.

Days Sales Outstanding (DSO) Ratio

The Days Sales Outstanding (DSO) Ratio is a financial ratio that measures the average number of days it takes for a business to collect payment on its accounts receivable.

The formula for the ratio is:

DSO Ratio = (Accounts Receivable / Total Credit Sales) x Number of Days

A low DSO Ratio indicates that a business is collecting payments quickly, while a high ratio indicates that a business is taking longer to collect payments. By comparing the DSO Ratio over multiple periods, a business can track changes in AR Days and identify areas where improvements can be made.

In addition to these ratios, businesses can use other financial ratios, such as the Current or the Quick Ratio, to monitor changes in AR Days and assess their overall financial health. By regularly tracking changes in these ratios and making adjustments as needed, businesses can improve their AR Days management and maintain a healthy cash flow.

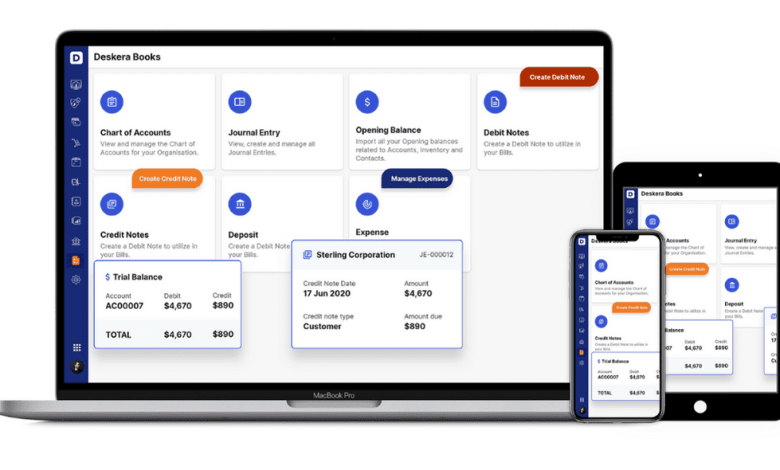

How can Deskera Help You?

To get paid faster, all businesses want to save time by automating the invoicing and payment collection processes. Deskera Books allows you to digitize the entire AR process. You can avoid printing and mailing paper invoices to your customers.