Investments

how to invest in the stock market

Investing in the stock market can be a great way to grow your wealth over time. Here’s a simple guide on how to get started:

- Educate Yourself: Start by learning the basics about the stock market and individual securities composing the market. There are plenty of free resources online, including articles, courses, and seminars.

- Set Clear Goals: Before investing, define your financial goals. Are you saving for retirement, to buy a house, or to fund a child’s education? Your goals will influence your investment strategy.

- Create a Budget: Determine how much money you can afford to invest. Never invest money you can’t afford to lose.

- Choose a Brokerage Account: You’ll need to open a brokerage account to start investing. Compare fees, benefits, and services of different brokers before making a decision.

- Learn to Read Stock Tables/Quotes: Stock tables/quotes provide valuable information about the stocks. They tell you everything from what the stock’s daily high and low are, to how much the stock’s value has changed over time.

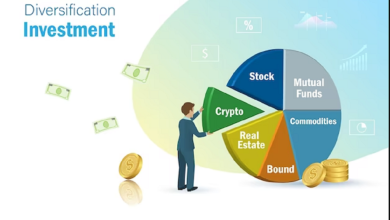

- Start with a Diversified Portfolio: Don’t put all your eggs in one basket. Spread your investments across a variety of sectors and companies.

- Regularly Review your Portfolio: The stock market is dynamic and your portfolio should be too. Regularly review and adjust your investments as needed.

- Stay Patient and Consistent: Stock market investing is a long-term commitment and requires patience. It’s not about making quick bucks, but about growing your wealth over time.

Remember, it’s always a good idea to seek advice from a financial advisor or do thorough research before making any investment decisions.

Why can we invest in the stock market?

Investing in the stock market offers several benefits and opportunities for individuals and businesses. Here are some reasons why people invest in the stock market:

- Wealth Growth: Over the long term, investing in stocks has historically provided higher returns compared to other investment options like bonds, real estate, or savings accounts. This can help you grow your wealth and achieve financial goals.

- Passive Income: Some stocks pay dividends, which provide a regular stream of income for investors. This can be particularly useful for those looking to generate passive income or supplement their earnings.

- Diversification: Investing in the stock market allows you to diversify your investment portfolio, reducing overall risk. By spreading your investments across various sectors and asset classes, you can better manage potential losses.

- Inflation Protection: Stocks have the potential to outpace inflation, preserving the purchasing power of your money. This is especially important for long-term investments, such as retirement savings.

- Ownership in Companies: When you buy stocks, you become a shareholder in the company. This means you have a stake in the company’s success and may have voting rights on certain issues.

- Liquidity: The stock market offers relatively high liquidity compared to other investment options. This means you can easily buy and sell stocks, making it convenient to access your money when needed.

- Tax Benefits: In some countries, investing in the stock market can provide tax advantages, such as lower capital gains tax rates or tax-free accounts for retirement savings.

It’s important to keep in mind that investing in the stock market also comes with risks, and there’s no guarantee of returns. Always do thorough research and consider seeking advice from a financial professional before making investment decisions.